Today, I'm going to show you one way poor people can buy land with no money. Let's go, welcome to Becky's homestead! Music. You have the strong desire to buy land. You really want to homestead for you and your family, but you have no money, bad credit, or no credit, and you just feel hopeless. Well, I'm here to tell you there is a way you can do it, and I know because I did, and now I'm mortgage-free. This is the perfect time of year to get started because you're going to be using your tax return, so don't touch it. Okay, step one is you're going to scour the papers. I found, when I was doing this, the little local papers just had the best deals. What I did is if you live in this county, obviously you're going to get the papers in your county, but cross the line into the other counties around you if this is the general area you want to live and get all the papers from all the counties. Then go home and just sit there with a sharpie and just scour the papers. Obviously, what you're looking for is owner finance. You're trying to look for land for sale by owner because there's no way you can go through a bank. A bank is never going to give you a loan because you have no money for a down payment, you have bad credit, or no credit, so forget it. They will not even consider you. But there's still hope in doing it this way because that's what I did. This is my personal model that I live by: small, small, small. Go small. You don't need as much as you think. Just in your mind, you picture this huge...

Award-winning PDF software

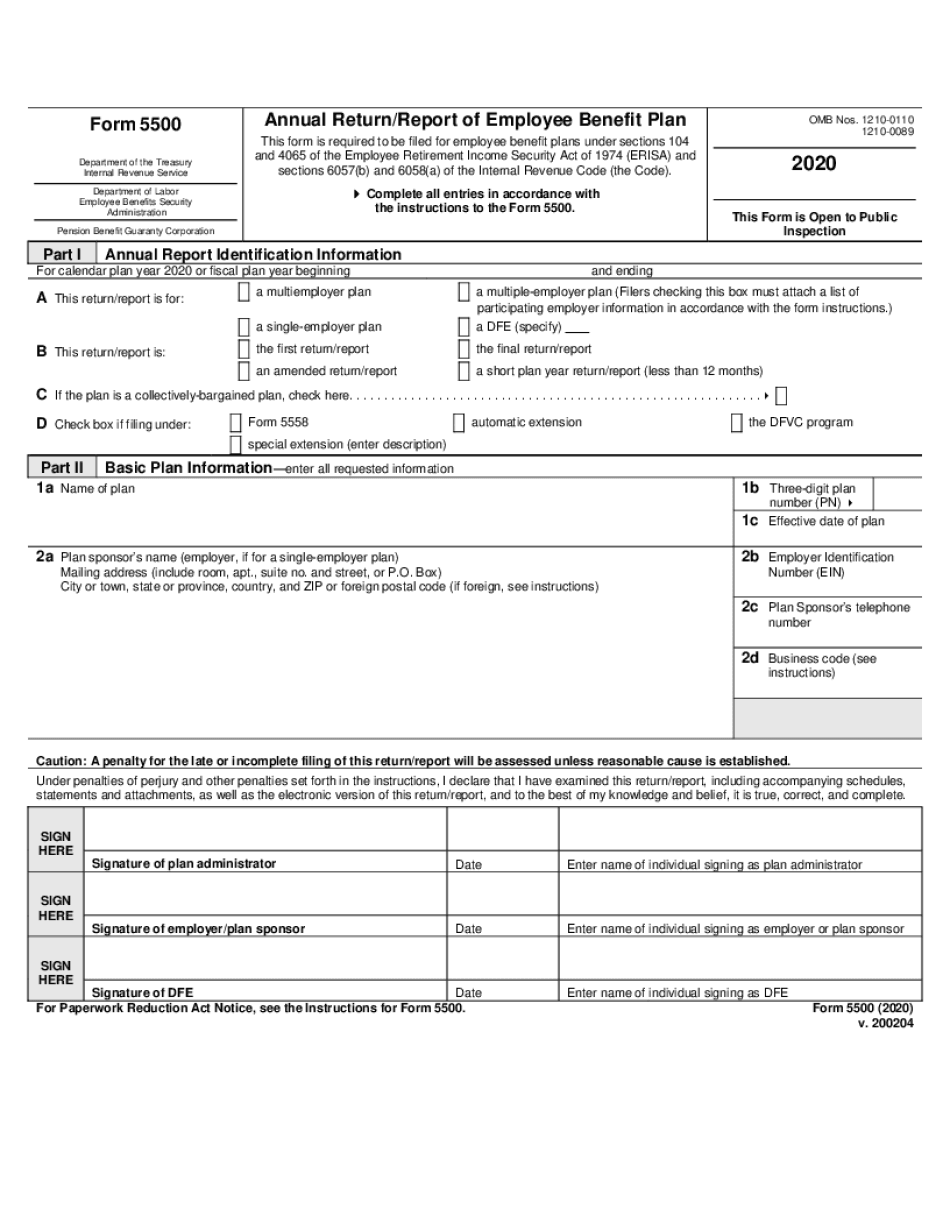

Who is exempt from filing 5500-ez Form: What You Should Know

June 2025 – 3) Self-Employed Only Plan — A retirement plan which excludes all current employee and former employee contributions, or, if you are a plan that provides an annuity to a member who becomes an April 2025 – 4) Employee Organization Only Plan — A plan in which an employee is not a member of an employee organization is usually exempt from filing the June 2025 – 5) Individual Retirement Arrangement — Individuals who are covered by a retirement plan that contains retirement and survivor benefits other than an annuity are excluded from filing the How to File a Form 5500-EZ — Filing Forms Online How to File a Form 5500-EZ — Online Filing You must file the return on the last day of the seventh month after your plan year ends (July 31 for a calendar-year plan). Forms will be returned. June 2025 – 6) Social Security — Any individual who is an employee covered by a retirement plan that provides benefits other than annuity, including an annuity (that is, benefits provided in the form of an annuity that may be taxed), is excluded from filing the If you are an employee covered by a social security plan, you must file Forms 5500-ESR, 5500-RVR, and 5500-SSS (Form 5500 SS). If you are an employer covered by a social security plan and who is an eligible employer for the Social Security Act, the FICA excise tax is withheld as though your plan qualifies as a social security program, not a retirement plan. If you are an employer that is eligible to claim the self-employment tax exclusion, and you want to claim the self-employment tax exclusion for employees covered by social security plans, you may not need to file Form 5500-EZ. What is not exempt from the FICA excise tax If you are an employee covered by Social Security and an employer and you elect to deduct your social security contributions, that amount may apply to your wages and/or gain you derive from this amount. An annual plan that is subject to section 202 of the law must not change its benefits in a subsequent year. If you make such an election under your plan, you must adjust the benefits provided to your employee so that after the election the benefits provided to your employee will meet the requirements of section 202(c).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5500, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5500 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5500 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5500 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Who is exempt from filing Form 5500-ez