Award-winning PDF software

Form 5500 Salt Lake City Utah: What You Should Know

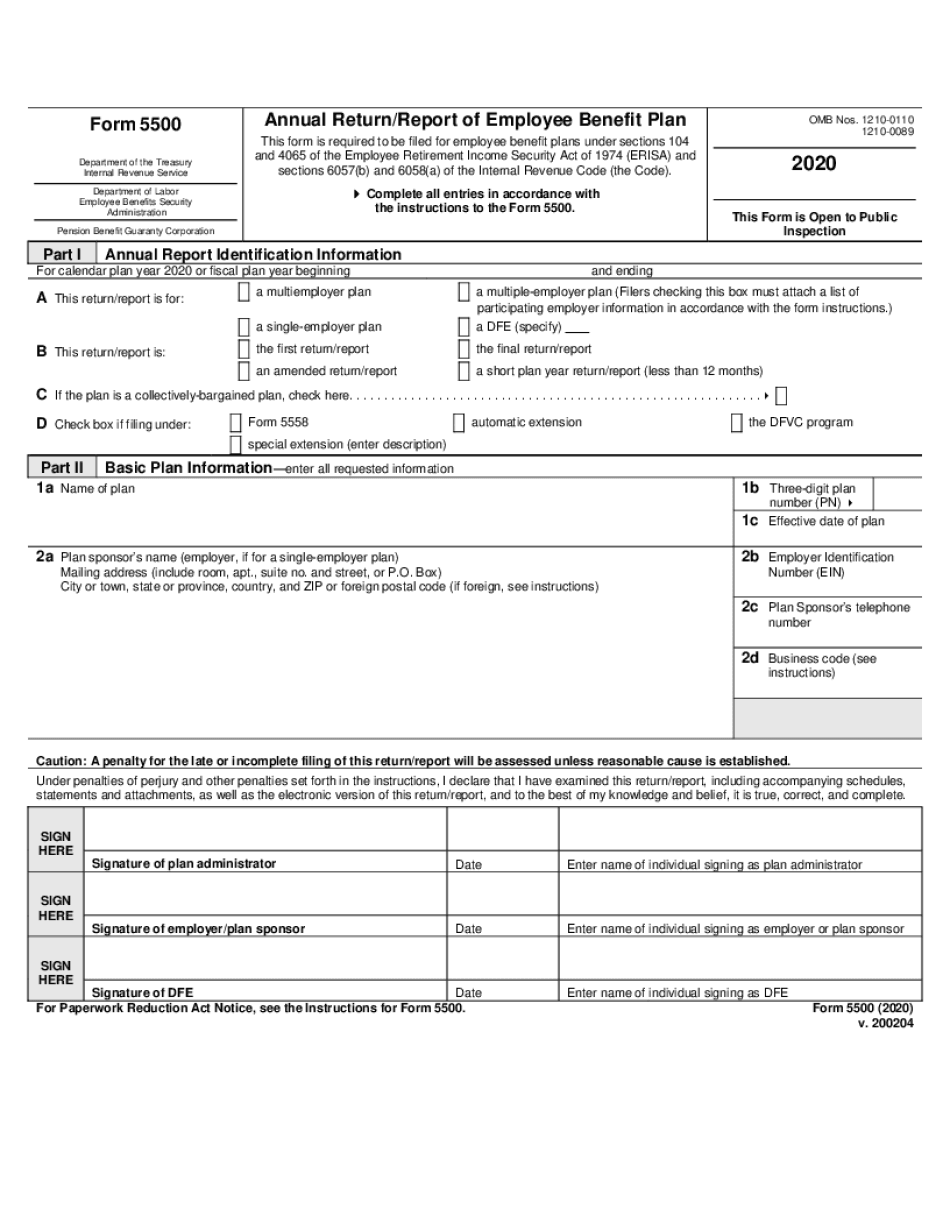

The ERICA Audit Services program is designed to provide your employee plan with the information and services required by ERICA in order to comply with the requirements of the Employee Retirement Income Security Act (“ERICA” or the “Act”). In our comprehensive review process, we focus on the following areas: 1. Employer eligibility (i.e. is the employer an eligible enterprise?) 2. Plan information (e.g. number and type of plans in the plan, beneficiary demographics) 3. Plan data (e.g. annual participant fees, annual service charges, and contribution amounts) 4. Compliance with ERICA with respect to: a. the plan; b. contribution, withdrawal, and payment frequency rates; c. age determinations; d. investment selection criteria; For a complete description of the ERICA Audit Services program, please refer to ERICA's FAQ's. ERICA Audit Services will also review ERICA Form 5500 reports submitted by employees. If a report indicates that an employer does not meet the employee's eligibility criteria, ERICA will make all reasonable efforts to obtain more information on the employer's compliance with the Act. If an employer fails to provide these additional necessary data, and if an employee still wishes to make the ERICA Audit Services report, the report may not be completed. In such cases, as a result of our investigation, an official notice of noncompliance will be sent to the employer indicating as much and directing the employer to correct any deficiencies before an ERICA Audit Services report can be completed on the employer. In addition, the notice will include a letter to the employee requesting the name, address, and phone number of a human resources individual to contact regarding the employer's compliance program. ERICA also will not take any action against any employer for failing to provide ERICA access to documents that were provided to it by the company or for failing to comply with the Act. If the employer does not correct the deficiencies, we will not proceed with a report that ERICA requests, and will include an official notice of noncompliance with the Act. To learn more about ERICA's ERICA Audit Services report process, please review our ERICA Audit FAQs In order for your eligible employee benefit plan to be audited by ERICA, you must obtain documentation (written or electronic) from the employer about their Employee Benefits Plan.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5500 Salt Lake City Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5500 Salt Lake City Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5500 Salt Lake City Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5500 Salt Lake City Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.