Award-winning PDF software

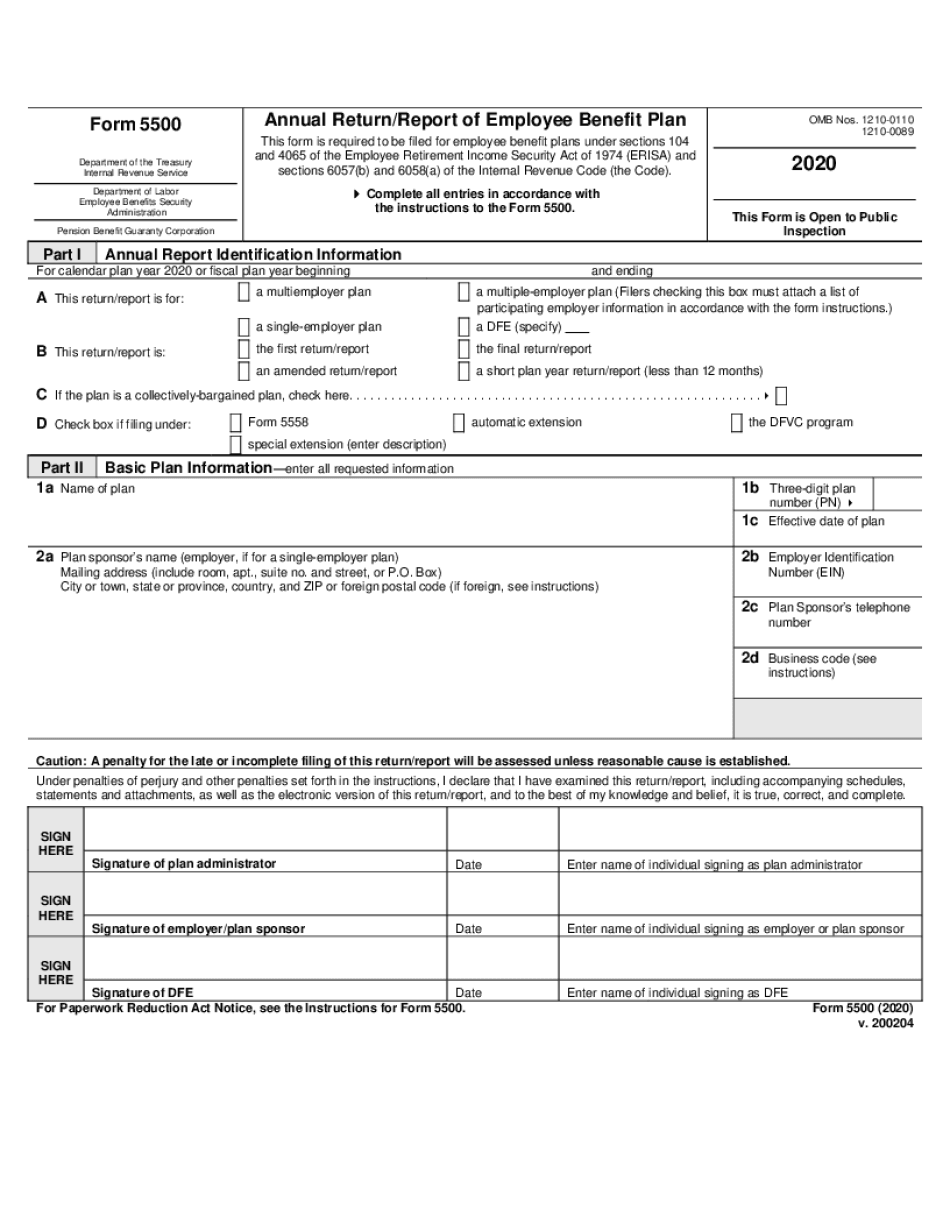

Form 5500 Wilmington North Carolina: What You Should Know

This is a very important tool to help you understand what is going on for your account and for the IRS. This website is for Posting on This site is for Posting on The IRS Form 5500 Series returns can include much information such as: (1) Social Security number (SSN). (2) Employer Identification Number (EIN). (3) Employer Identification Card Number (EIC). (4) Employee Identification Number (EIN). The SSN should not be the only number provided. Please follow instructions for your local tax office to complete Form 5500-SF. Do what you can to ensure your return is received by the IRS on time. The IRS sends out regular e-mails containing reminder's and reminders to make sure you are aware of the deadlines for your return. It is frequently suggested that you should review the website, IRS.gov, as often the IRS may give you information regarding your return. There is no recommendation to not update the website. The IRS uses the website for a variety of purposes. The IRS is a Government agency that handles tax matters for the US government to collect taxes or enforce taxes. The IRS is also part of the Department of Health and Human Services. The IRS has various trends that you, a government agency or agency within a government entity, should know about. You should also receive annual financial statements and/or notices for your agency or an entity. These reports need to be filed by May 15. When a government agency, or organization, submits a Form 1099-MISC electronically, the IRS collects the information from the agency or entity's computer equipment. The form then becomes part of the public records of the IRS and can be used by any taxpayer to challenge any amount improperly attributed to them. Posting on (1) Social Security number (SSN). (2) Employer Identification Number (EIN). (3) Employer Identification Card Number (EIC). The SSN should not be the only number provided. Please follow Instructions for your local tax office to complete Form 5500-SF. Do what you can to ensure your return is received by the IRS on time.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5500 Wilmington North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5500 Wilmington North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5500 Wilmington North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5500 Wilmington North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.