Award-winning PDF software

Printable Form 5500 Newark New Jersey: What You Should Know

Federal agency rules expand the annual minimum plan participant contribution to 2,500 for employers and 5,000 for participants. The IRS does not enforce these limits. They are the employer's decision. Dec 15, 2025 — IRS announces new annual minimum contributions rules for 403(b) plans that will require plan sponsors to increase the annual minimum contribution to employers by 2.5% and to participants by a 10% fee per participant for 2025 and beyond. This applies only to 403(b) plans for plan participants who have at least six prior years of plan participation. The IRS expects to reach the 2,500 and 5,000 requirements in early 2009. In the meantime, employer plans, such as 401(k)s, 401(k)s with additional employer contributions or plans with high income limits, are likely subject to the IRS' rules by mid-year 2009, provided the plans meet the requirements. If employer plans like 401(k)s and 403(b) plans don't meet the requirements, plan participants, such as self-employed individuals, should contact their plan sponsor and advise them that their plan may be subject to the 2025 contribution limits as long as participants are over age 50, according to IRS officials. The plan sponsors may be required to increase the maximum contribution under the new annual limits. “The plan sponsor needs to be sure that their 403(b) will meet the limit because when the limit changes there is a one-year lag,” said Laura E. Passer, senior tax advisor with Fidelity and the author of “Retiring Your 401(k): Helping Your Financially Frugal Business Go Big!” “When you ask your employer about this process, you can also ask for a plan that meets the new limits and will increase your expected retirement income. Once they provide this planning support for your plan, you can take whatever steps are needed to maintain your plan's tax-deferred status,” Passer said. Employees can check their employers' website to see if they're in a 401(k) plan and to see what the rules are for contributing and withdrawing as an employee. The IRS states, “If the plans provide or enable employees to make contributions as an employee, those contributions must be considered compensation. Compensation includes wages, wages and tips, as well as amounts received from an employer (for example, pension payments, lump sum payments, and vacation benefits).

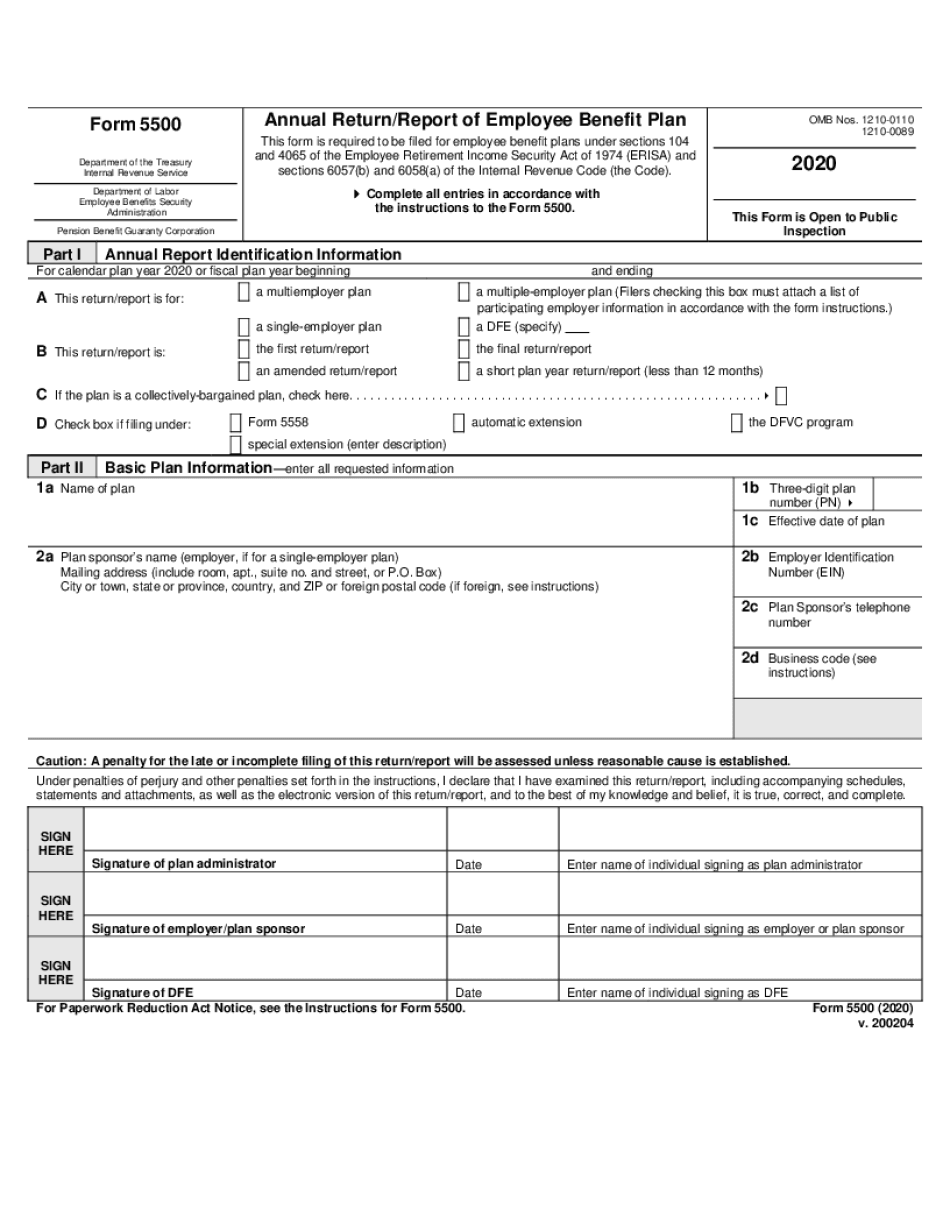

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 5500 Newark New Jersey, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 5500 Newark New Jersey?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 5500 Newark New Jersey aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 5500 Newark New Jersey from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.