Award-winning PDF software

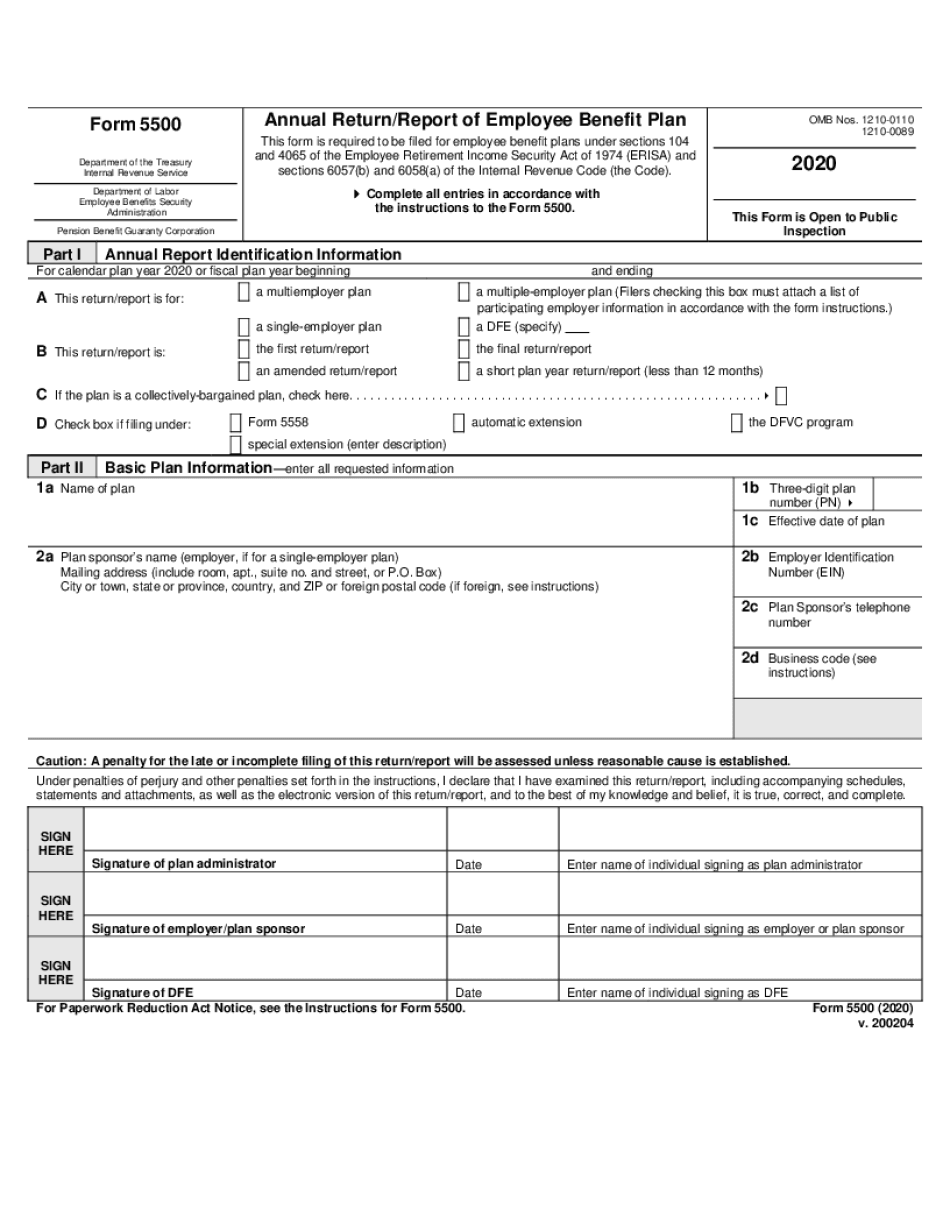

Printable Form 5500 Westminster Colorado: What You Should Know

Department of the Treasury. Internal Revenue Service. Supplemental Retirement Income Report for Plans for Individuals Form 5500 — EFAST2 This form is used to compute the amount to be included in an IRA contribution. A form 5500 is used to report the total amount contributed to the Roth IRA of an individual. The contribution is not considered to be a taxable event. If a Roth distribution is made to an individual, the Roth IRA deduction is allowed. Roth's distributions are considered distributions in the year of the contribution. This means the individual cannot deduct the amount in their previous year contribution if the year prior to the contribution the individual only contributed the tax-free amount as a first-year Roth contributor. For more information refer to the IRA/RED articles at Money.org. 2022 Form 5500 — The IRS Form 5500—The IRS provides information to provide individuals a convenient method to estimate the amount of annual IRA contribution made. There are two different methods to calculate annual contribution; one using a combination of the Traditional and Roth IRA distributions, and another using a combination of both distributions. Using only the Distribution Method for the calculation of total contributions, if the distributions exceeded the limit for IRA contributions and the person exceeded the IRA contribution limit then an additional calculation (deducting the excess under the standard method and counting it as the total contributions) is made. Use of the Combined Method for the calculation of total contributions will make the contribution tax-free. The Combined Method calculation requires that the amount of the contribution has been fully withdrawn on or before the end of the calendar year prior to the year in which the contribution is made. For example, if an individual made a contribution to 5/1 and had fully withdrawn the amount of the contribution before the end of the calendar year in which the contribution was made, then this contribution would be in the amount of 2,750 (5/1 + 1/31). The Combined Method calculation is not available for rollovers from one year to the next or for contributions taken before January 1, 1992. For more information refer to IRA and rollover articles at Money.org. 2024 Form 5500-F — IRS The Form 5500-F is used to report the amount of a tax-free contribution to a qualified retirement plan. An individual may deduct only IRA or Roth contributions made prior to January 1, 1984.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 5500 Westminster Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 5500 Westminster Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 5500 Westminster Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 5500 Westminster Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.