Award-winning PDF software

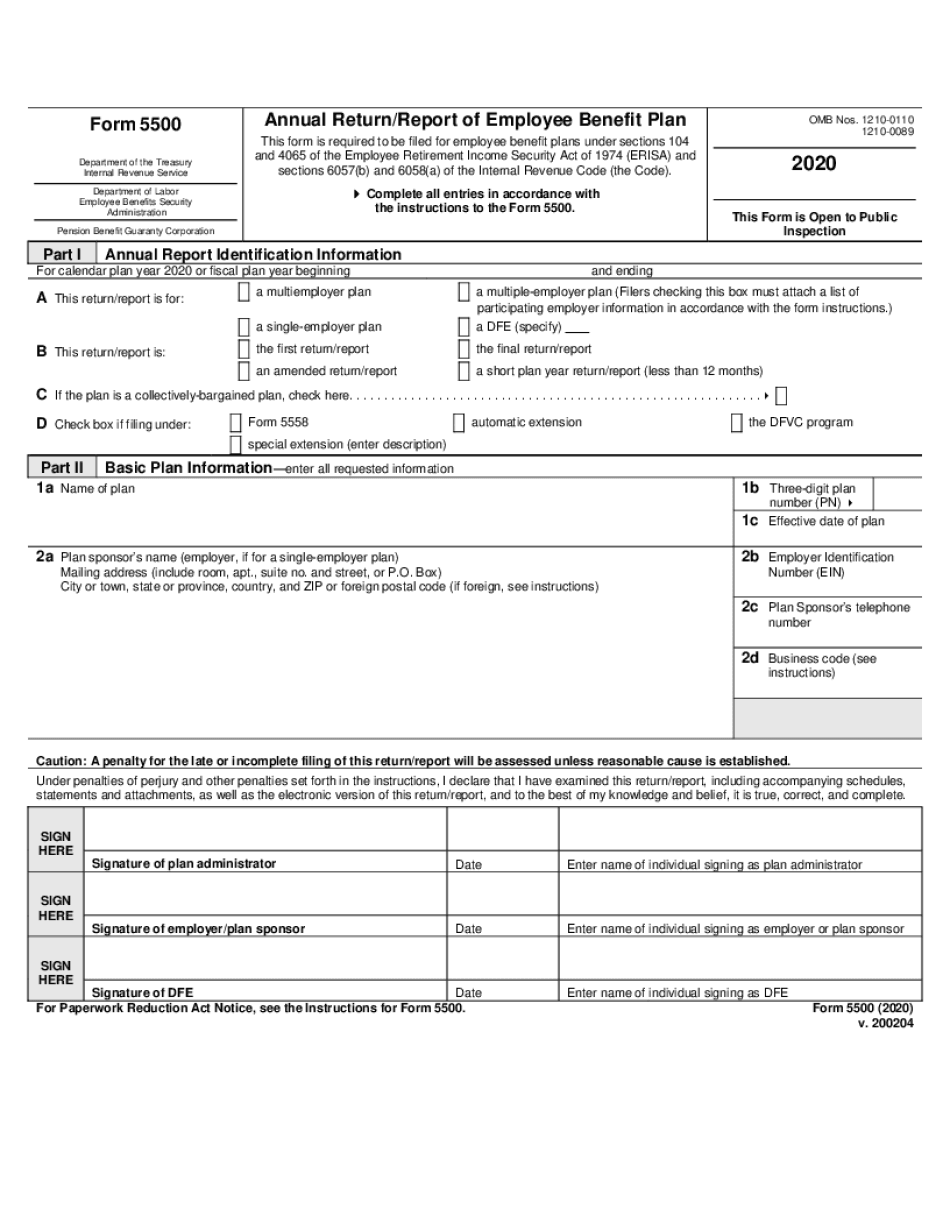

Thousand Oaks California online Form 5500: What You Should Know

The Honda of the Year — Automotive The Honda of the Year is the official name of the award given annually to the most outstanding automobile model, as selected by judges for its outstanding design or quality, production value, or innovation in the industry, including all categories including luxury and performance. The Honda of the Year is sponsored by Honda Motor Co. of America. Honda of the Year — Automotive. The Honda of the Year, which was presented in 2008, was the best vehicle in five categories: design, quality, durability, efficiency and performance. The judges based their selection of the award on a panel of more than 250 automotive experts from the United States, Canada, Europe, Asia, Australia and South America. Honda of the Year — Automotive. The Honda of the Year, which was presented in 2000, was the best vehicle in four of the five categories: design, sustainability, efficiency and innovation. The judges based their selection on a panel of more than 170 automotive experts from Japan, Korea, Australia, the United States and Canada. Fees & Taxes | IRS You are not an Individual. You are a Sole Proprietor, Partnership, Inc., or Company. Your business entity status and tax information is determined by the type of business entity established by your Form 1120, Employer's Qualified Small Business (Form 1120-S) Application. If you are not a sole proprietor or partner in a partnership for the tax year, see Form 1120-S Publication in the Instructions for Form 1040/1040A. Do Business with Us — Tax Tips for Taxpayers Filing the Federal Income Tax can be challenging, but it's not impossible. Many professionals rely on the assistance of our tax advice attorneys. Taxation by attorneys. An attorney can: assist you determine your tax status and answer your questions; provide you advise on your federal tax obligations and tax planning options; advise you on what kind of business you operate in order to minimize your obligations and maximize your opportunities; guide you through the many tax obligations for small businesses; explain when to file and when to appeal tax actions and when to get professional help; provide information about self-employment tax and employment taxes; and help you prepare for, meet, and comply with the financial reporting requirements of IRS Form 1095-C, Annual Income Tax Return for Small Business. Tax Form: 1099.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Thousand Oaks California online Form 5500, keep away from glitches and furnish it inside a timely method:

How to complete a Thousand Oaks California online Form 5500?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Thousand Oaks California online Form 5500 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Thousand Oaks California online Form 5500 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.