Award-winning PDF software

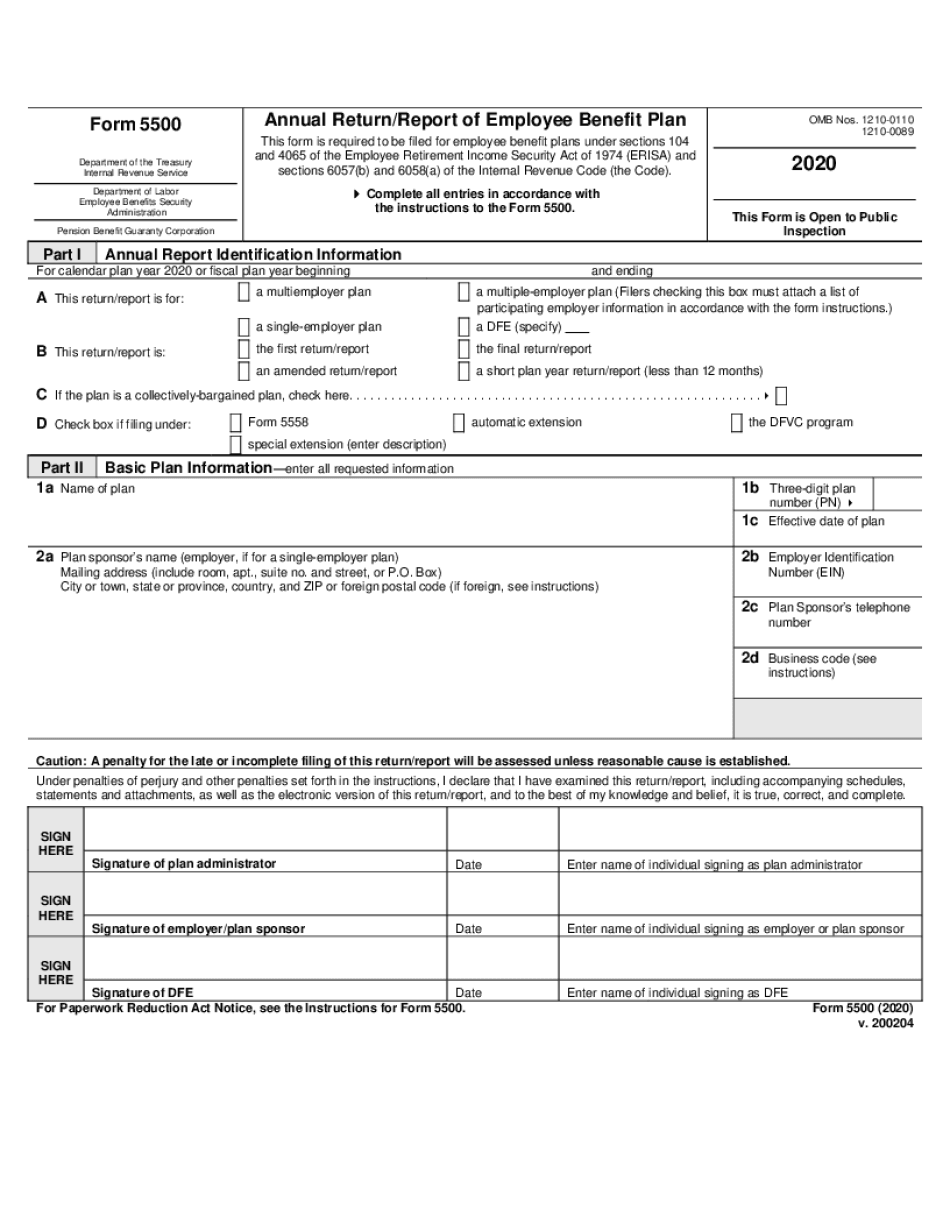

Form 5500 for Palm Beach Florida: What You Should Know

Our experienced team provides the following services: Wrangle: Erring, Inc. is a registered trademark of Erring Inc. All rights reserved. The National Pension System is a program of the US Congress created in the National Employment Protection Act of 2006. The National Pension System is funded by the Payroll Tax Act of 1954, administered by the US Office of Personnel Management. The National Pension System is an independent federal pension program operating under the Payroll Tax Act of 1954 and is administered by the US Office of Personnel Management and subject to the Payroll and Other Collection of Moneys Act, 29 U.S.C.A. § 901 et seq. The National Pension System is a system administered by the Retirement Equities and Benefits Administration (REBA) of the US Department of Labor. The National Pension System offers retirement compensation to qualified public-sector employees who have been employed by the Federal Government for one year or more. The pension is administered by the Federal Retirement Thrift Investment Board, which is a member agency of the US Department of Labor. The Retirement Equities and Benefits Administration (REBA) is part of the US Department of Labor's Office of the Associate Administrator for Financial Stability. The Payroll Tax Act of 1954, as amended, and the Railroad Retirement Act of 1974 were passed by Congress on March 27, 1952, and March 11, 1974. The purpose of these federal statutes is to promote the proper allocation and funding of benefits of employee retirement systems. These laws are meant to provide for the orderly and efficient management of the Federal Government's public employee retirement system, while protecting the integrity of those retirement systems. The Payroll Tax Act of 1954 provides for the distribution of a payroll tax to the States from the Federal Government's general fund revenues. On February 16, 1958, Congress amended the Payroll Tax Act to impose the first federal payroll tax. The Tax Act of 1954 was amended with retroactive applicability of certain provisions during the 1960s. The Payroll Tax Act of 1954, as amended, and the Railroad Retirement Act of 1974 were passed by Congress on March 27, 1962, and March 11, 1974. Prior to the enactment of the Federal Insurance Contributions Act (FICA), an employer had to pay the tax from the employee's wages.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5500 for Palm Beach Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5500 for Palm Beach Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5500 for Palm Beach Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5500 for Palm Beach Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.