Award-winning PDF software

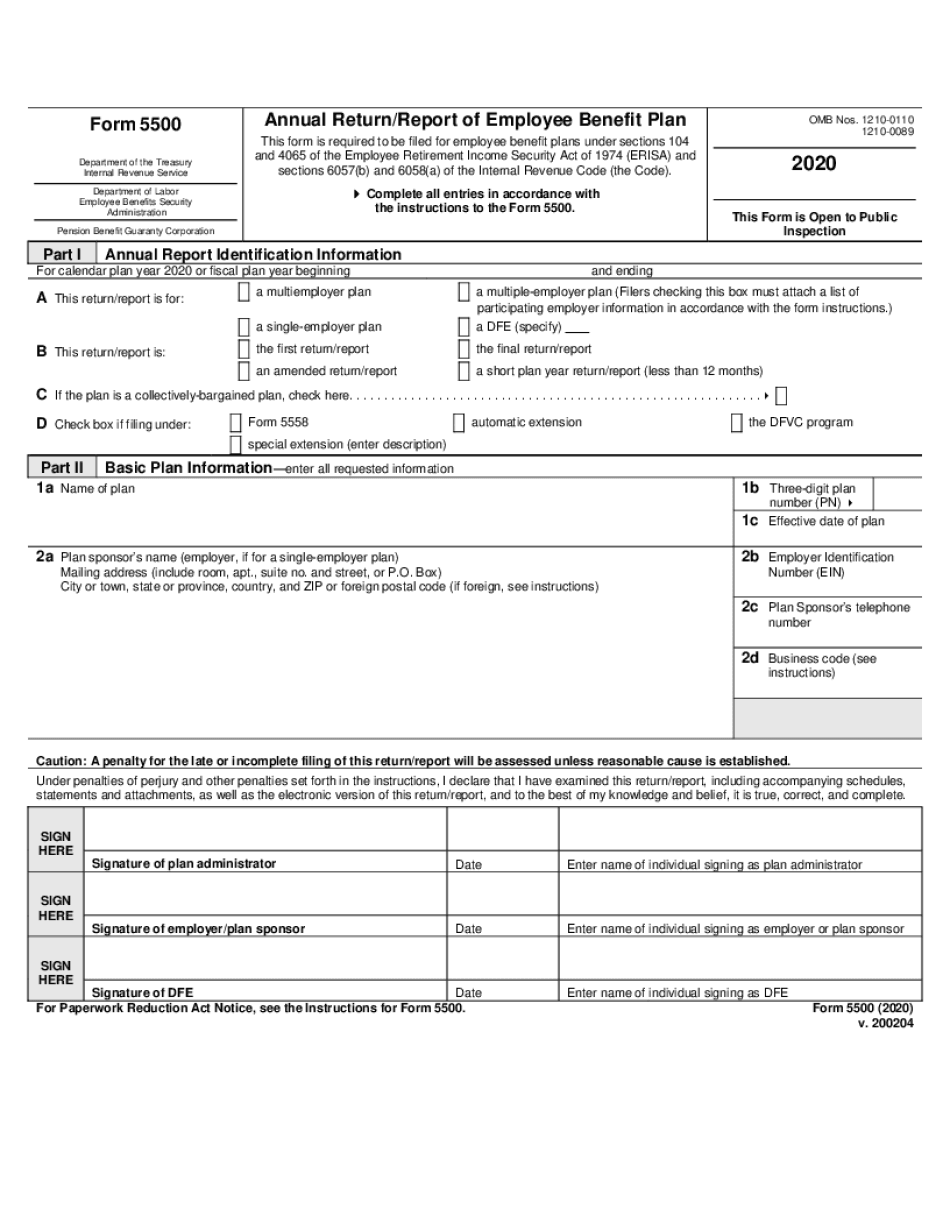

Ohio online Form 5500: What You Should Know

Note: If you have any questions about the requirements of the Form 5500-EZ, please contact your local Wage and Hour Division office. Sep 27, 2025 — Form 5500-EZ Updated For current information, visit our Form 5500 section. Jun 26, 2025 — Form 5500-EZ Updated, Part I — A Form for Injured Workers. For all information, visit our Form 5500 section. May 20, 2025 — Form 5500-EZ Updated, Part II — Form 5500-EZ — Frequently Asked Questions. For all information, visit our Form 5500 section. Feb 21, 2025 — Form 5500-EZ Updated — Frequently Asked Questions. Jan 20, 2025 — Form 5500-EZ Updated — Section II. Form 5500-EZ — Frequently Asked Questions. For all information, visit our Form 5500 section. Oct 19, 2025 — Form 5500-EZ Updated — Forms to file with the federal government for injured workers. Oct 19, 2025 — Form 5500-EZ Updated — Forms to file with the federal government for injured workers, if you have had an injury or illness in the 10 years preceding the filing date. Sept 16, 2025 — Form 5500-EZ Updated — Forms to file with the federal government for injured workers. Sept 12, 2025 — Form 5500-EZ Updated — Records of an injured worker. July 28, 2025 — Form 5500-EZ Updated — Forms to file. For any questions, call your nearest wage and hour division office or check with the “contact us” at the end of this page. For questions about what your employer can deduct from your paycheck, visit our Wages, Hours, and Benefits page. Learn more about the injured worker program. If your employer has not been paying you for at least 1,250 hours in the past 12 months, and you were self-employed in at least 10 of the 12 months, you are eligible for a tax deduction of up to 2,000. If your employer has paid you more than 1,250 for 10 and less than 12 months, you are eligible for up to 2,000 for both consecutive years. See Form 843 to report wage and hour violations.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Ohio online Form 5500, keep away from glitches and furnish it inside a timely method:

How to complete a Ohio online Form 5500?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Ohio online Form 5500 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Ohio online Form 5500 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.